Project 0 Integrates DeFi Lending Protocol Drift

Now 70% of Solana Lending TVL is accessible with unified margin, credit through Project 0.

Liquidity fragmentation in DeFi continues to be a pain point for users. You deposit on Kamino for one set of rates and on Drift for another. Each platform treats your positions in isolation, each one demanding its own collateral buffer, blind to what you’ve deployed elsewhere.

The result is massively inefficient capital allocation and increased liquidation risk, as well as the constant overhead of managing multiple margin accounts that should be working together.

With the launch of Project 0 and our integration with Kamino, we began to solve this problem. Today, we’re expanding the solution to include Drift, bringing another major venue into the unified margin ecosystem.

Here’s what that means in practice:

- Borrow against your combined collateral: Your P0, Drift, and Kamino holdings now all fall under one unified margin account.

- Better value through portfolio margining: When P0 sees your complete portfolio across all venues, it can offer better risk parameters than single platforms operating in isolation.

- Manage everything through one interface: Check your exposure, rebalance positions, and monitor risk all from P0. No more platform-hopping needed to get a complete picture of your portfolio.

Why This Matters Now

Drift has established itself as a major DeFi lending venue with competitive rates and solid liquidity. However, like every other platform, it operates in isolation, which has become a consequence of the evolution of DeFi infrastructure.

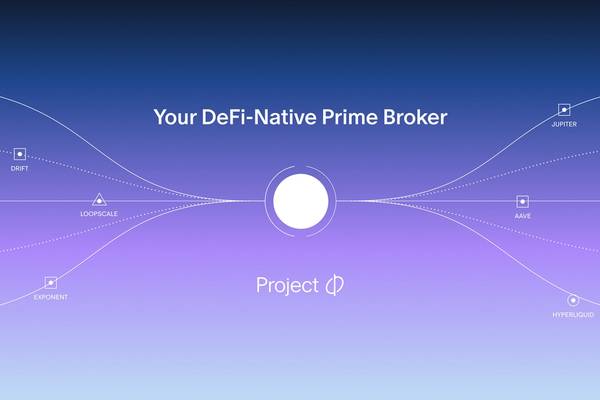

P0 exists to fix that isolation; not by replacing the platforms, but by connecting them. We make it possible for your capital to work as intelligently across venues as it does within them.

This is our second major lending integration, but the playbook is proven. Unified margin works, capital efficiency improves, and risk management becomes simpler.

What’s Next

Drift lending is another step toward P0’s complete vision: every major DeFi venue operating under a unified margin account. More lending markets are on the roadmap. Integration of perps is on deck. Each addition expands the range of strategies users can execute with a single pool of capital.

If you’re already using P0, you know how this improves the ecosystem. If you’re not, it’s time to experience the benefits of a unified profile for yourself.

The infrastructure is live. Drift is integrated. Your capital can work smarter.

Related Articles

Continue reading

Kamino Market is live on Project 0Apply for early access

Kamino Market is live on Project 0Apply for early access